Welcome to Shanghai Founder Law Firm! Email:info@gcls.cn Tel:0086-021-62996116-0

11-25

In 2026, we will travel to the future together, with the establishment of the Manshan Island team by Guochuang headquarters and Suzhou branch

From November 21st to 23rd, 2025, Guochuang Law Firm organized its headquarters and Suzhou branch colleagues to conduct a three-day autumn team building and business exchange activity on Manshan Is..

11-19

KHOR SEE LIN, Senior Partner of YEOH MAZLINA&PARTNERS Law Firm, Visited Shanghai Guochuang Law Firm

On November 19, 2025, Lawyer KHOR SEE LIN, Senior Partner of YEOH MAZLINA&PARTNERS Yangma Law Firm, visited Shanghai Guochuang Law Firm. Chen Min, Director of Shanghai Guochuang ..

11-11

MMALATIN CEO Mr. Diego Martinez Bernie visits Shanghai GuoChuang law firm

On November 6, 2025, Diego Martinez Bernie, CEO of MMALATIN, visited a law firm in Shanghai. Chen Min, Director of Shanghai Guochuang Law Firm, Ji Xin, Partner, and Li Runxuan, Legal Assist..

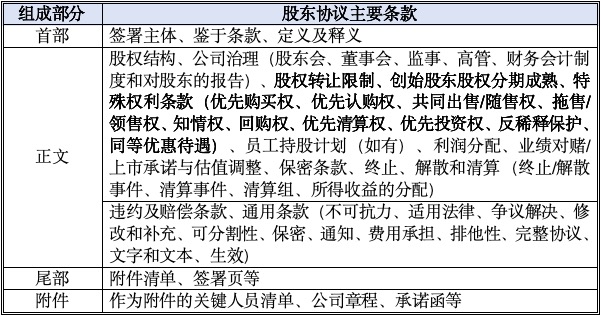

Continuing from the previous article, this article will interpret the key provisions of the shareholder agreement. In order to protect their own investment interests and have a certain say and exit protection in the future development of the company, investors usually set up a series of clauses in the shareholder agreement (SHA) that grant them special rights as a shield for self-protection.

1、 Overview of the main terms of the shareholder agreement

2、 Review of Key Provisions in Shareholders' Agreement

(1) Corporate Governance TermsThe corporate governance provisions cover the composition and powers of the board of directors, the establishment and operation mechanism of the shareholders' meeting/supervisory board (including the method of convening, time of convening, resolution rules, etc.). The common contradiction in science and technology innovation companies is the decision-making conflict that may arise between the technical and business factions.

1. Distribution of seats on the board of directors/supervisory boardFrom the perspective of investors, investment institutions generally strive to arrange board seats in the target company, as the company's general operational resolutions are made by the board of directors. If directors can be arranged to participate in the target company's operational decisions, investment institutions can deeply participate in the company's business activities.

2. Voting mechanism design - veto power with one voteFor investors, a higher threshold for approval is usually set, such as a board resolution requiring the consent of two-thirds or more of the investor's directors, or a shareholder resolution requiring the approval of two-thirds or more of the voting rights represented by shareholders, including the investor.

For the target company, even in the face of strong investors, efforts should be made to avoid granting a single investor "veto power" (i.e. requiring their appointed directors to agree or their own voting rights to pass in order to make the resolution effective), in order to ensure the autonomy of the founding shareholders in the company's business operations. Although such requirements reflect investors' concerns about being "bypassed", they can lead to low decision-making efficiency and even deadlock in the company. If the investor is relatively strong, the right to set up such a "veto power" must be related to major issues of the company and should not affect the company's daily business decisions, in order to minimize the impact on the company's normal operational efficiency. If the company has multiple founding shareholders, it may consider signing a unanimous action agreement, which stipulates that unanimous action will be taken when the shareholders' meeting/board of directors votes. For companies that have reached a certain stage of development, it is possible to study and consider using the provisions of the new Company Law on class shares to set up shares with higher voting rights (i.e. super voting shares). It is also possible to consider stipulating in the company's articles of association that the consent of the founding shareholders is required for specific matters such as changing the main business and transferring core technologies, in order to ensure control over key decisions.

(2) Founding shareholder equity restriction clause

1. Restrictions on equity transfer

Given that the stability of the founding team is crucial for the company's development and investment security, investors typically require the controlling shareholder and founding shareholders not to transfer their equity holdings in the company without their consent.

On the premise of ensuring the equity structure and operational stability of the company, the target company and founding shareholders may add exceptions to equity transfer restrictions in practice, such as transferring for the purpose of implementing employee equity incentives, transferring to affiliated parties under their actual control, or cumulatively transferring equity not exceeding a specific proportion (such as 5%) of the company's total share capital after financing completion, in order to reserve necessary equity operation space for the founding team.

2. Maturity of equity installment (unlocking mechanism)

This mechanism often appears in earlier investments (such as seed rounds, angel rounds, etc.) to continuously bind founding shareholders and the company.

When investors require founding shareholders to comply with the principle of restricted equity, they usually include all of their shares in the regulatory scope. The common way to redeem restricted equity is through a tiered redemption process, with a redemption period of 3-5 years. The shareholder documents of the project also stipulate that in the event of some negligence by the founding shareholders that causes damage to the company, their shareholding needs to be delayed for unlocking.

As a founding shareholder, we should strive for a shorter unlocking period and a more relaxed unlocking mechanism as much as possible. If the founding shareholder resigns before the unlocking period expires, the company will generally arrange for a repurchase of the founding shareholder's shares. Depending on the reasons for the founding shareholder's resignation (voluntary resignation, wrongful resignation, forced resignation), the repurchase price will generally vary and should be agreed upon as specifically and clearly as possible.

(3) Investor Special Rights Clause

1. Right of First Refusal

The right of first refusal refers to the right of other specific shareholders to purchase the underlying equity of a company under the same conditions as other shareholders and/or external third parties when a shareholder intends to transfer their ownership of the company's equity. In venture capital transactions, the holder of the right of first refusal is usually the investor, and the corresponding obligor is usually the founding shareholder of the company. It is one of the most frequently mentioned priority rights in venture capital transactions.

For the target company and founding shareholders, when accepting the pre emptive right proposed by the investor, whether to impose certain restrictions on the right, and whether to impose reverse pre emptive rights on the investor's equity transfer, can be comprehensively evaluated based on the specific transaction situation and commercial negotiation position. From the perspective of protecting the founding shareholders, exceptions can be set for exercising the pre emptive right, such as agreeing on internal transfers, equity incentives, structural adjustments for listing, triggering anti dilution clauses, etc., where the investor cannot exercise the pre emptive right.

2. Right of First Refusal

The right of first refusal refers to the right of investors to subscribe for the newly issued equity/shares (i.e. new shares) of the company under the same conditions when the company increases its registered capital. Compared with the right of first refusal, the right of first refusal is the right of investors to subscribe for the newly issued equity/shares (i.e. new shares) of the company.

For the target company and founding shareholders, certain clauses can be set to restrict this right, such as stipulating that investors can only subscribe based on the proportion of company shares held before the capital increase; The agreement stipulates that when the investor exercises the right of first refusal in subsequent financing, the shareholding ratio after capital increase shall not exceed a certain proportion; The agreement stipulates that investors can only oversubscribe for this portion when other investors have not fully exercised their preemptive rights, and not for all newly added registered capital, in order to minimize the impact on the control rights of the founding shareholders.

3. Co sale/Tag Along Rights

The joint sale/tag along right grants investors an option - when other shareholders intend to transfer the company's equity, they have the right (but not the obligation) to request the joint sale of their equity under the same conditions and their own shareholding ratio. The primary factor for investors to invest in science and technology innovation enterprises is based on trust in the founding shareholder team. After becoming a shareholder of the science and technology innovation enterprise, the actual operation and management of the enterprise by the investor is still the founding shareholder. In order to prevent the founding shareholder from cashing out of the company and the investor from being trapped, the investor usually requests that this right be set up in the agreement.

From the perspective of the target company and founding shareholders, whether to accept this clause depends on their bargaining power; If the company has a promising future and is favored by multiple institutions, the founding shareholders may consider refusing this right.

4. Dragging/Collecting Rights

For investors, the deferred/lead sale right is considered a key right clause by professional investment institutions. Investors investing in science and technology innovation enterprises may not necessarily aim to hold equity for the long term. Many investors plan ahead on how to exit when investing. The core content usually stipulates that if the target company and/or founding shareholders/original shareholders violate the representations and warranties, or if the repurchase obligor fails to fulfill the repurchase obligation on time after triggering the repurchase clause, the investor has the right to sell its equity in the company to any third party who intends to purchase it. When the investor exercises the right to sell based on this, and the potential acquirer requests to purchase more equity than the investor's own shareholding, the investor has the right to force the founding shareholder to sell the corresponding equity directly or indirectly held by them in the company under exactly the same trading conditions, in order to meet the overall needs of the acquirer and ensure the smooth transfer of the investor's equity.

From the perspective of the target company and the founding shareholders, once the right to put on a sale is exercised, the enterprise and even the core technology that the founding shareholders have invested years of effort in building may be relinquished, forcing them to reluctantly sell their equity. This is the biggest risk that the right to put on a sale poses to the founding shareholders. For the founding shareholders, it is necessary to be highly vigilant and cautious in the setting of the deferred sale right clause. Efforts should be made to avoid accepting such arrangements during negotiations to prevent significant risks of losing control over the company due to the exercise of this clause. If the investor is relatively strong, in order to balance the interests of the founding shareholders and the investor, the deferred sale right can be set with some preconditions for exercising the right:

·Temporal prerequisite: For example, the investor can only exercise the put option N months/N years after the signing of the transaction documents (this type of setting is mostly in early rounds of financing, and in relatively later rounds of financing, the enterprise has already matured and market changes are highly unpredictable).

·Valuation prerequisite: It is agreed that the investor can only exercise the put option when the acquirer's acquisition valuation reaches a certain amount.

·Voting prerequisite: In cases where there are multiple investors and the company has multiple financing rounds, it is agreed that the deferred sale right can only be exercised with the consent of a certain percentage of the company's shareholders who hold more than two-thirds, or even more than 75%, of the voting rights of the company.

5. Repurchase Right

Given the information barriers between investors, the company, and the founding team, as well as the high uncertainty of the company's future development, the repurchase clause has become a key mechanism for investors to ensure their exit.

Investors usually require the target company, controlling shareholders, and actual controllers to jointly act as the repurchasing entities, achieve qualified listing (listing bet) within a certain period of time in the future, achieve annual net profit or main business income reaching the agreed amount standard (performance indicator bet), and require that the actual controllers and controlling shareholders shall not change, or the core management team shall not undergo significant changes. Otherwise, investors have the right to require the aforementioned repurchasing entities to repurchase their equity holdings in the target company. The repurchase price is usually the investment amount of the investor plus an annual rate of return ranging from 6% to 10%, and the specific rate of return also needs to be determined through consultation between the investor and the target company.

For the target company and founding shareholders, there are few investment institutions in the current investment and financing trend of the science and technology innovation industry that require founding shareholders to jointly and severally bear the repurchase responsibility. In order to reduce the liability risk of founding shareholders and actual controllers, it can be stipulated in the investment and financing agreement that the repurchase obligation undertaken by founding shareholders and actual controllers is limited to the value of their equity holdings in the target company at that time, which can be evaluated and determined by a third-party professional evaluation agency. This requires the controlling shareholder and actual controller to transfer their own equity to obtain equity transfer funds, and then use the equity transfer funds to repurchase the investor's equity in the target company, thereby avoiding the controlling shareholder and actual controller from repurchasing equity with personal cash assets and easing their financial pressure. In addition, the target company may set a repurchase exercise period in the investment and financing agreement, stipulating that within a certain period of time (such as 90 days) from the date of triggering the repurchase conditions, the repurchase right holder must issue a written exercise notice during this period. Failure to notify within this period will be deemed as a permanent waiver of the right.

6. Right to know

The right to know is essentially a statutory right granted to shareholders by laws such as the Company Law, rather than a special right. Given that investors usually do not participate in the daily operations of the company, they are particularly concerned about the financial and operational status of the company. Therefore, investors usually require the company to regularly provide agreed financial statements and data, and submit the financial report and audit report of the previous year audited by a qualified accounting firm on time every year. To ensure the authenticity of data, cautious investors may also limit the qualifications of audit firms or require them to choose from a list of recognized institutions. However, it should be noted that the exercise of this right to information must be based on good faith and maintained within a reasonable range.

7. Priority liquidation right

The priority liquidation clause is designed to safeguard the core exit demands of investors and to incentivize founding shareholders to operate the enterprise.

From the perspective of investors, try to define a relatively complete range of events that are considered liquidation. In statutory liquidation, the unified distribution of funds by the company is beneficial for investors to receive priority compensation; During mergers and acquisitions, the shares of both parties are often sold simultaneously, and the transfer proceeds may be paid separately to the founding shareholders and investors, which may result in insufficient income for the investors. At this point, it is reasonable for the founding shareholders to make up the difference up to the amount of the merger and acquisition proceeds they have received.

For the target company and the founding shareholders, in some special circumstances, if the company undergoes statutory liquidation for distribution, or if the founding shareholders pay all the merger and acquisition funds received to the investors, it is still not enough to cover the priority income of the investors. In this case, if the founding shareholders need to make up for it, they will need to bear the additional burden on the founding shareholders with assets other than their shareholding in the target company. The specific acceptance of this clause depends on the specific situation. In cases where some companies are relatively dominant, they may set an upper limit on the total amount of priority liquidation for investors, or set a certain trigger threshold (for example, if a company is acquired for a certain amount, investors can only choose between the principal+interest model or the equity based acquisition amount distribution model).

8. Anti dilution protection

In order to protect investors from the depreciation of their equity due to the company's issuance of new shares at a lower valuation (i.e. price reduction financing) in subsequent financing, anti dilution clauses are usually included in the agreement. There are two main types of anti dilution clauses: complete ratchet and weighted average.

·Full Ratchet: It is the most protective measure for early investors, but the most severe dilution method for founding shareholders and other shareholders of the company (including employee option pools). Once the next round of pricing is lower than the previous round, the conversion price of early investors will directly drop to the new round price, allowing them to obtain more shares, and the equity of the founding team will be significantly diluted.

[Example]

Investor A invested 1 million yuan at a price of 10 yuan per share and obtained 100000 shares (accounting for 10% of the shares). The company has issued a total of 1 million shares. During subsequent financing, the company will issue new shares at a price of 5 yuan per share, triggering a full ratchet clause. The investment price of Investor A has been adjusted to 5 yuan, and its shareholding will automatically be adjusted to 200000 shares (1 million yuan ÷ 5 yuan) to maintain its investment value.

·Weighted Average: It is a relatively mild and more common method. It will calculate a new weighted average conversion price based on the number and price of newly issued shares, as well as the investment amount and original price of early investors. (Calculation formula: Adjusted stock price=Original stock price x (Total number of shares before investment+Number of shares that new investors can subscribe to at the original stock price)/(Total number of shares before investment+Number of shares subscribed by new investors at the new stock price)

[Example]

Investor A invested 1 million yuan at a price of 10 yuan per share and obtained 100000 shares (accounting for 10% of the shares). The company has issued a total of 1 million shares. In the subsequent financing, the company will issue 500000 new shares at a price of 5 yuan per share, corresponding to a total financing of 2.5 million yuan.

The new conversion price is 10 yuan multiplied by (1 million shares+250000 shares)/(1 million shares+500000 shares)=8.33 yuan.

In order to protect their rights and interests, the investors in this round usually require that the cost of equity participation of new investors in subsequent financing should not be lower than the current round price. Otherwise, they have the right to demand that their shareholding value be recalculated according to the new valuation and receive cash or equity compensation from the founding shareholders/controlling shareholders.

For the target company, given that subsequent financing valuations usually increase, the increase in capital increase price itself is not easy to trigger anti dilution. However, it should be noted that if the investors in this round also acquire old shares at a low price, they may require that the subsequent transfer price of old shares should not be lower than their acquisition price. Due to strategic considerations such as introducing collaborators or employee incentives, the founding/controlling shareholders may need to transfer some of their old shares at a low price. Therefore, it is recommended to explicitly limit the anti dilution clause to only apply to the actual next round financing price, thereby excluding the application of the old stock transfer price and avoiding false triggering. If possible, consider negotiating with investors to set a maximum adjustment limit to avoid unlimited dilution.

9. Equal treatment clause

If the target company has more favorable terms and conditions than those granted to the investor in this agreement in subsequent financing (including equity financing and debt financing) or agreements signed with existing shareholders and investors (including but not limited to the front wheel investment agreement), the investor shall automatically enjoy such more favorable terms.

This clause is related to the anti dilution clause, but does not conflict with it. Because the most favorable terms are not limited to equity financing of the rear wheel, but may also include debt financing and so on.

The target company and the founding shareholders may jointly undertake to restrict the granting of special treatment to other investors, and clarify that if additional rights or benefits are granted to other shareholders, the investors in this round have the right to enjoy such preferential treatment under the same conditions, in order to prevent unequal rights between investors. For the founding shareholders, whether to accept it or not should depend on the specific situation. In my opinion, it is not unacceptable to provide investors with equal preferential conditions for this clause.

(4) Employee Stock Ownership Plan

During the establishment or early stages of a science and technology innovation company, a portion of equity may be reserved as needed for equity incentives for core technical employees, or an employee stock ownership platform may be set up in advance to hold the company's incentive equity pool for future distribution. However, in practice, it is also common for companies to require further equity incentives to motivate employees/attract new technological talents.

From the perspective of investors, it is more recommended for the founding shareholders to transfer a portion of their own company equity to form a new equity pool for incentives, without diluting the holdings of other shareholders in the company.

From the perspective of the target company and the founding shareholders, the founding shareholders suffer relatively little damage, and all shareholders are equally diluted. Founding shareholders often hope to use this method for equity incentives. To balance the interests of both parties, the following methods are commonly used in shareholder agreements:

·The agreement adopts the model of issuing new shares and transferring old shares: that is, the company issues a portion of the new registered capital, and the founding shareholders also contribute a portion of the old shares. The investor and founding shareholders each take a step back and make their own contributions.

·Setting performance conditions: It is stipulated in the shareholder agreement that the company may issue new shares for employee incentives, provided certain performance prerequisites are met;

·Setting valuation criteria: It is stipulated in the shareholder agreement that the company may issue employee incentives when the new round of financing valuation reaches a specific amount.

(5) Valuation adjustment mechanism

Valuation adjustment mechanism, commonly known as "performance betting", is a very common risk management method. It is usually a series of clauses designed by investors to bridge the cognitive gap between the current valuation and future development prospects of the company and the financing party (i.e. the target company and/or founding shareholders), or to reduce investment risks caused by information asymmetry. The core content is that if the target company's operating performance (such as net profit, operating income, user growth, and other key indicators) fails to meet the predetermined goals in a specific period in the future, or if the company fails to achieve a qualified IPO within the agreed time, the financing party (which may be the target company itself, the founding shareholders, or both) needs to compensate the investors to a certain extent. Common compensation methods include:

·Cash compensation: The financing party pays a certain amount of cash to the investor.

·Equity compensation: The financing party (usually the founding shareholder) transfers a portion of its company equity to the investor free of charge, or the target company issues a portion of equity to the investor at a low price.

·Equity repurchase: Equity repurchase is the core clause of a gambling agreement, which usually stipulates that the investor has the right to demand that the financing party (target company or founding shareholder) repurchase part or all of its equity holdings at an agreed price (usually the investment principal plus a certain fixed annualized return rate, usually in the range of 8% -15%). It should be noted that if the target company's share repurchase constitutes a reduction in registered capital, it should comply with the legal procedures and voting requirements for capital reduction.

From the perspective of the target company and founding shareholders, it is advisable to make cautious commitments, strive for reasonable adjustment methods, prioritize compensation through equity, avoid cash based performance as much as possible, prevent fund chain breakage, and set reasonable performance targets and buffer periods. The most important thing is to clearly limit the compensation obligation to the target company level and avoid joint liability of individual founding shareholders. In addition, the listing plan should take into account the capital market environment. Under the current trend of strict IPOs, it is not advisable to easily commit to a short-term listing. It is possible to consider adding a tiered mechanism to the betting terms, such as triggering partial compensation or punishment when achieving 80% to 90% of the target, and triggering full compensation only when the target is below 80%.

(6) Agreement Non Conflict Clause

During multiple rounds of financing, the company needs new and old shareholders to jointly sign a new agreement due to issues related to governance, liquidation, and repurchase order, which may result in conflicts of terms between different versions of the agreement. To avoid future disputes, it should be clearly stipulated in the current financing agreement that from the effective date, all conflicting terms in previously signed agreements shall automatically become invalid, and the content of this round of agreements shall prevail.

Conclusion

Science and technology innovation enterprises usually have high growth and innovation, and financing can help these enterprises obtain necessary financial support to promote key activities such as technology research and development, market expansion, and talent introduction, accelerate enterprise growth, and achieve their business vision.

For technology companies, investment and financing agreements are not only legal documents, but also gambling contracts between technological routes and commercial resources, and they need to maintain rational design of terms in the capital boom. Under the dual drive of "technology+capital", the target company and founding shareholders need to combine their own needs and business considerations, accurately grasp the risks of agreement terms, clarify contractual responsibilities, and strike a balance between meeting financing needs and controlling liability risks, in order to effectively safeguard their own and the company's rights and interests.

Lawyer Liu Jing graduated with a master's degree from the School of International Finance Law at East China University of Political Science and Law. She has worked for multinational corporations, securities companies, and public fund management companies, with a complex professional background. She has in-depth theoretical research and rich practical experience in fund investment, corporate governance, and data compliance, and has sustained sensitivity and insight into financial product innovation and regulatory dynamics.

Lawyer Liu Jing has been in the industry for more than ten years, providing comprehensive legal advisory services to various enterprises all year round. She fully understands the impact of macro regulatory environment on project investment. Lawyer Liu is able to dynamically apply laws and regulations to conduct detailed risk assessments in advance. By sorting out the business logic of target projects and combining it with tax collection management practices, she can achieve more effective risk control.

Lawyer Liu Jing is particularly skilled in providing comprehensive services and risk control opinions for the fundraising, establishment, investment trading, and fund accounting of RMB and USD fund projects. Her advisory clients include securities companies, fund companies, futures companies, provincial investment platforms, government guided funds, etc.

Lawyer Liu Jing has qualifications in securities, funds, and futures, and holds certified certificates in data compliance and risk control. She is currently a member of the Fund Business Committee of the Shanghai Bar Association, a researcher at the Capital Market Research Center of East China University of Political Science and Law, and a practical mentor at the Law School of Shanghai University of Finance and Economics.

Benlin

Mobile number: 18301983120

Email: benlin@gcls.cn