Welcome to Shanghai Founder Law Firm! Email:info@gcls.cn Tel:0086-021-62996116-0

11-25

In 2026, we will travel to the future together, with the establishment of the Manshan Island team by Guochuang headquarters and Suzhou branch

From November 21st to 23rd, 2025, Guochuang Law Firm organized its headquarters and Suzhou branch colleagues to conduct a three-day autumn team building and business exchange activity on Manshan Is..

11-19

KHOR SEE LIN, Senior Partner of YEOH MAZLINA&PARTNERS Law Firm, Visited Shanghai Guochuang Law Firm

On November 19, 2025, Lawyer KHOR SEE LIN, Senior Partner of YEOH MAZLINA&PARTNERS Yangma Law Firm, visited Shanghai Guochuang Law Firm. Chen Min, Director of Shanghai Guochuang ..

11-11

MMALATIN CEO Mr. Diego Martinez Bernie visits Shanghai GuoChuang law firm

On November 6, 2025, Diego Martinez Bernie, CEO of MMALATIN, visited a law firm in Shanghai. Chen Min, Director of Shanghai Guochuang Law Firm, Ji Xin, Partner, and Li Runxuan, Legal Assist..

The current AI industry is experiencing a surge in financing, serving as a crucial engine for the development of new productive forces. Behind the capital frenzy lies a competition between investors and financing parties over competitiveness and decision-making power amid vast market prospects. In investment projects, the most critical aspects are drafting two key agreements: the Share Purchase Agreement (SPA) and the Shareholders Agreement (SHA). In some cases, institutions may consolidate these two agreements into one, collectively referred to as the "investment agreement." While the SPA focuses on detailing the transaction itself and its execution, the SHA emphasizes long-term arrangements such as rights and obligations, corporate governance, and exit mechanisms. Together, they complement each other, ensuring the smooth progress of the transaction and the stable operation of the invested company.

This article is divided into two sections: the first section provides a detailed analysis of the functions and clauses of the capital increase agreement, while the second section interprets the key terms of the shareholder agreement. The aim is to offer solutions and revision suggestions for the main review points in both agreements by examining them from the perspectives of investors, the target company (the entity receiving equity financing), and the founding shareholders.

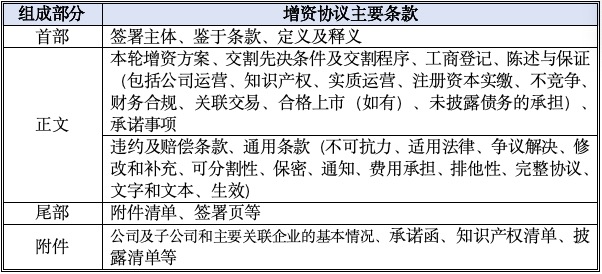

I. Summary of Key Provisions in the Share Purchase Agreement

II. Review of Key Provisions in the Capital Increase Agreement

(1) Subject Identity

From a legal perspective, the initial establishment of a company involves two types of entities in terms of financing: founding shareholders and the target company. Whether the founding shareholders have fulfilled all their obligations to the company, whether they hold equity on behalf of others, and whether their corporate or individual status implies certain background information about the company's early structure are fundamental prerequisites for investment projects. Investors must not overlook these aspects in their due diligence.

In a typical capital increase agreement template, the parties involved generally include three categories: founding shareholders, the target company, and investors. At first glance, all parties share highly aligned interests, as they all hope that after this financing round, the target company can secure stable cash flow and legally and compliantly grow stronger. The transaction structure determines the extent to which founding shareholders can realize their interests. Whether investors fund through a master fund or a platform fund affects the enforceability of fund-level terms on the investment. Whether the target company assumes rights and obligations separately or consolidates them with the founding shareholders determines the liability-sharing mechanism between the two. Of course, if the company has an IPO plan, its identity naturally defaults to post-listing restrictions and tax planning. These factors, among others, make it imperative to carefully scrutinize the parties' identities in the agreement's preamble.

(2) Terms of Capital Contribution and Business Registration

According to the new Company Law, shareholders of a limited liability company must fully pay their subscribed capital contributions (including any newly added registered capital) within five years from the date of the company's establishment.

In practice, when raising funds through capital increase, enterprises may agree with investors to make a one-time payment or pay the capital contribution in installments based on funding arrangements, achievement of operational targets, or the progress of transaction consideration payments. If installment payments are chosen, the parties may negotiate the payment schedule, but the final payment deadline must not exceed five years. Additionally, the capital increase agreement should stipulate the corresponding amendments to the company's articles of association.

From the perspective of protecting the company's interests, it is advisable to strive to initiate and complete the industrial and commercial registration changes regarding the newly added registered capital and new shareholders simultaneously or shortly after receiving the initial investment payment, thereby enhancing the certainty of the transaction.

【Judicial Practice Case - The Impact of Whether to Handle Industrial and Commercial Registration on Whether Investment Funds Can be Returned for the Termination of Capital Increase Agreements Due to Reasons】

The termination of the capital increase agreement will involve changes in the equity of the financing party. Due to factors such as the prohibition of capital withdrawal and the protection of the interests of the company's creditors, even if the agreement has been terminated, whether the industrial and commercial registration has been changed will affect whether the investment funds can be directly returned.

1. Failure to complete industrial and commercial registration and judgment to return investment funds: In the (2019) Supreme People's Court case No. 1738, the investment agreement was terminated due to the failure to complete industrial and commercial registration. However, since the investment has not been registered for capital increase and change with the industrial and commercial administrative department, the capital increase has not yet had a public effect on the company's creditors, and the company's creditors do not have any trust interests that need to be protected. Therefore, the court's judgment to return the investment funds does not involve the issue of damaging the interests of the company's creditors due to withdrawal of capital or failure to reduce capital according to legal procedures.

2. The business registration has been completed and the return of investment funds is not supported: In case No. (2019) Hu 01 Min Zhong 11265, the investor has become a shareholder of the financing party through business registration, but the agreement was terminated due to the investor's failure to pay the investment funds in full and on time. The court believes that in the case where the investment made by the investor has been converted into company capital, special provisions of the Company Law should be applied for enforcement. Although all parties involved in this case have confirmed the termination of the agreement, they have not specified the specific way for the investor to withdraw, such as through equity transfer, equity repurchase, company capital reduction, company dissolution, etc., nor have they gone through the corresponding legal procedures. In this case, the investor's request to return the investment funds is essentially equivalent to shareholders arbitrarily withdrawing their capital without legal procedures, which will result in an improper reduction of the company's assets. Obviously, it violates the principles of determining, maintaining, and maintaining the company's capital, directly affecting the company's operating ability and the protection of creditors' interests.

(3) Investment Method Clause

After the implementation of the new Company Law, for non monetary assets such as equity and debt that can be valued in currency and legally transferred for investment, the procedures and requirements for non monetary asset investment should be clearly stipulated, and corresponding evaluation procedures and decision-making procedures of the board of directors and shareholders' meetings should be followed. The assets used for investment should be transferred to the company within the agreed period.

Science and technology innovation companies often encounter situations where founding shareholders contribute intellectual property, and the agreement should confirm all the actual payment obligations of the founding shareholders, including completing the corresponding intellectual property transfer filing/registration procedures. The investor who contributes intellectual property rights does not necessarily have to limit their rights to the ownership of the intellectual property rights, but also includes the right to use the intellectual property rights. In addition, taxes and fees (if any) arising from non monetary property contributions are usually borne by the contributing party, unless otherwise agreed by both parties.

【The process and risks of intellectual property valuation and equity investment】

Step 1: Confirm that the investor holds intellectual property rights that are relevant to the company's business scope. In the civil judgment (2023) Lu 03 Min Zhong No. 282, due to the fact that the technology actually used by the investor for investment belongs to a service invention and is not the owner of the technology involved in the case, it constitutes unauthorized disposal. The fact that the investment cooperation agreement involved in the case is illegal and unauthorized disposal will fundamentally lead to the inability to achieve the purpose of the contract, which affects the performance of the entire contract. Therefore, the Zibo Intermediate People's Court has determined that the investment cooperation agreement involved in the case is invalid.

Step 2: Intellectual Property Value Assessment. In practical operation, whether the investing shareholder entrusts the evaluation agency or the accepting company entrusts the evaluation agency requires mutual consultation and decision. It is generally recommended to entrust in the name of the company, which can reduce the risk of the evaluation report not being recognized. Although it is difficult to achieve very accurate results in intellectual property evaluation, the relevant evaluation procedures of the evaluation agency in the process of evaluating the value of intellectual property must be fully implemented, otherwise there is a risk that the intellectual property investment of the investor will be identified as false and untrue. In practice, companies and shareholders who contribute intellectual property may sometimes agree on defective/untrue (property depreciation) clauses, which means that when the actual value of non monetary assets such as intellectual property is lower than the assessed price or experiences significant depreciation, shareholders should bear the responsibility of making up for it within a limited and appropriate scope.

Step 3: Sign the intellectual property investment agreement and modify (formulate) the company's articles of association. After being evaluated by a qualified evaluation agency, the investor shall promptly sign an intellectual property contribution agreement with other shareholders, clarifying the details of the intellectual property contribution such as the contribution method, proportion, and period. Then, the shareholders' meeting shall revise the company's articles of association based on the capital contribution agreement and evaluation report. The articles of association shall record the methods of shareholder capital contribution, including the valuation of intellectual property rights. Especially when investing in technology achievements, it is necessary to confirm the name, content, and other detailed technical information of the technology achievements used for investment. Otherwise, significant misunderstandings may occur, resulting in the consequences of unrecognized investment.

Step 4: Transfer intellectual property ownership. The time node for the change of intellectual property ownership is determined by the type of intellectual property, such as "the transfer of patent rights shall take effect from the date of registration", "if the application for trademark transfer is approved, it shall be announced, and the party accepting the transfer of the exclusive right to use the registered trademark shall enjoy the exclusive right to use the trademark from the date of announcement", "if the transfer of intellectual property rights is made, a written contract shall be concluded".

Step 5: Hire an accounting firm, auditing firm, or other qualified institution to verify the capital contribution of intellectual property and issue a verification report.

Step 6: Submit to the market supervision department for review, handle the company's change registration and make it public. The company should promptly submit relevant materials to the local market supervision and management department for change registration, including a copy of the business license, intangible asset evaluation report, capital contribution agreement, company articles of association, proof of intellectual property transfer, copies of shareholders' and legal representatives' ID cards, intellectual property certificates, financial statements of the company for the past three years, etc. The specific requirements of the local market supervision and management department shall prevail.

Step 7: Apply for deferred tax filing. According to the Notice of the Ministry of Finance and the State Administration of Taxation on Improving the Income Tax Policies Related to Equity Incentives and Technology Investment (Caishui [2016] No. 101), "III. Implementing Selective Tax Preferential Policies for Investment and Investment in Technological Achievements", starting from September 1, 2016, if an enterprise or individual invests in technological achievements as shares, the consideration paid by the invested enterprise is all stocks (rights), and they can choose not to pay taxes immediately when the technological achievements are converted into equity, but to defer their tax obligations to the time of equity transfer. The aforementioned technological achievements refer to those funded by patents, computer software copyrights, exclusive rights to integrated circuit layout designs, new plant variety rights, new biopharmaceutical varieties, and other technological achievements determined by the Ministry of Science and Technology, the Ministry of Finance, and the State Administration of Taxation. After the actual payment is completed, the company shall promptly apply for indefinite deferred tax payment at the tax department in the company's location within the prescribed period. In addition, all other intangible assets, including trademark rights, patents, copyrights (including software copyrights), non patented technologies, etc., can choose to defer tax for five years, that is, pay income tax in full within five years.

(4) Delivery prerequisites

After completing due diligence on the target company, investors usually propose investment prerequisites for the identified operational issues, which are usually clarified through listing to ensure that the problems are properly resolved. The financing party (i.e. the target company and/or its founder) must first meet a series of specific conditions. From the perspective of the investor, it must be clearly stated in the agreement that signing the agreement does not necessarily mean that the investment must be made. Only when all the prerequisites listed in the capital increase agreement have been fully met, or if they have not been fully met but have been waived in writing by the party with the right to waive (usually the investor), will the investor have the obligation to pay the investment amount according to the agreement. Otherwise, the agreement can be terminated.

When verifying the prerequisites for delivery, the target company should pay attention to the following points:

Be cautious and ensure to reduce risks. Investors often require the target company to ensure that its core personnel (with a clear list to avoid ambiguity), assets, finances, and operating conditions have not undergone significant adverse changes, such as ensuring the stability of the core team and signing confidentiality, non compete, and service period agreements. The target company needs to carefully review the remaining term of the core employee's labor contract, especially when the investor requests to use the agreement signing date as the starting point for the service period, in order to avoid violating commitments.

Limit responsibility and control risks. Although it is inevitable for investors to demand guarantees and obligations from the target company itself, they often require both the controlling shareholder and founding shareholder to make commitments and assume compensation liability in case of violation of conditions. To control the liability risk of the founding/controlling shareholders, it can be stipulated in the capital increase agreement that their compensation liability is limited to the value of their equity holdings in the target company, excluding joint and several liability for personal property.

(5) Representations and warranties

1. Representations and warranties of the target company and/or founding shareholders

Common statements and warranties typically cover the subject qualification and authorization of the target company, the clarity and completeness of the equity structure, the ownership and condition of the company's assets (including tangible and intangible assets such as intellectual property), the comprehensiveness of the company's liabilities (including contingent liabilities), the authenticity and fairness of financial statements, the compliance of business operations, tax regulations, the legality of labor employment, the existence of undisclosed major contracts, litigation, arbitration or administrative penalties, and other aspects. This clause actually distributes potential risks related to the stated facts between the financing party and the investors.

For investors, statements and warranties are crucial. Due to the fact that investment institutions usually do not participate in the daily operations of the target company and may have limited understanding of its industry, coupled with the fact that they can only understand its financial and operational status through due diligence, it is difficult to completely rule out the risk of the company falsifying or concealing information. Therefore, this clause requires the target company and the founding shareholders to undertake and guarantee that the statements and information provided during due diligence and the entire investment process are true, accurate, complete, not misleading, and have no significant omissions; These guarantees remain valid; There is no concealment; If unforeseen significant adverse changes occur, the investor shall be notified promptly. If violated, the investor has the right to terminate the contract, demand the return of investment funds, and claim losses.

From the perspective of the target company, it is necessary to handle the scope of matters that require guarantees with caution. The strategy for dealing with statements and guarantees is to disclose them in detail and reasonably limit liability

Please attach a disclosure list/disclosure letter, listing all exceptions to the representations and warranties. For example, if the guarantee clause states "the company has no pending litigation" and the disclosure list indicates "the company is currently involved in a dispute case involving XX that is being tried in court", then the investor cannot pursue breach of contract liability in this lawsuit.

For matters that cannot be guaranteed to be true or accurate, efforts should be made to avoid making relevant guarantees and limit the guarantee obligation as much as possible within one's own knowledge. For example, only the core technical team, including the founder, has the most authoritative understanding of the time cycle from invention to finished product. However, even so, we cannot blindly make commitments to investors according to the optimal time node, try to split the time unit of technology transformation as much as possible, and maintain respect for technological uncertainty. This is not a suggestion to conceal information, but to emphasize that one should not accept guarantee terms beyond their own ability to confirm in order to obtain financing in a hurry, in order to avoid being passive and bearing excessive responsibility in the future. The founding shareholders may add wording such as "to the knowledge of the company and its founders" in the terms to avoid taking responsibility for situations that they are objectively unaware of.

If the investor insists on having the right to claim compensation for this, the deductible and upper limit should also be clearly defined. It can be agreed that only when the accumulated losses of the investor exceed a certain amount (such as RMB 500000) can a claim be made, and the maximum compensation limit for the guarantee obligation undertaken by the founding shareholders shall be stipulated, such as not exceeding the investment amount received or a certain proportion of the company's valuation, to eliminate unlimited liability.

In addition, the disclosure and commitment of non competition are more important in the representations and warranties of the target company and/or founding shareholders, which we will elaborate on in detail below.

2. Representations and warranties of the investor

Compared to the lengthy and complex statements and warranties that financing parties need to make, statements and warranties made by investors to financing parties (i.e. companies and founders) are usually simpler, roughly including factors such as subject qualifications, legality of funding sources, effectiveness of investment decisions, and non related party statements.

Although financing parties are usually in a relatively weak position in negotiations, they should still insist on requiring investors to make necessary statements and guarantees regarding their basic situation and core obligations. If the investor is involved in state-owned capital, it must ensure that its investment behavior complies with the relevant regulations of China on the supervision and management of state-owned assets, and has obtained the necessary approval or filing from the state-owned asset regulatory agency. If it involves foreign investment, it is necessary to ensure that it complies with China's foreign investment access policies (such as negative list management) and national security review requirements.

(6) Non competition clause

The non competition clause generally falls within the scope of representations and warranties made by the founding shareholders and core technical personnel. But how to understand non competition requires specific analysis based on practical experience and market reality. Talents are rare in the high-precision and cutting-edge fields, and universities will try their best to cooperate in incubating a group of high-quality innovative enterprises based on their production and investment goals. However, this also makes the cooperation and competition between universities, target companies, and investors more complex and diverse. The fundamental purpose of non competition is to ensure that the founding shareholders and core team are fully engaged in the operation of the company and are not directly or indirectly (including through related parties) engaged in business that competes with the company.

From the perspective of investors, summarize the scope of non competition as much as possible to increase the coverage of non competition clauses and prevent founding shareholders from exploiting loopholes in the clauses. Shareholders, directors, and core technical personnel of the company are required to sign non compete agreements, and those serving as directors, supervisors, and senior executives must also comply with relevant provisions of the Company Law.

For founding shareholders, they should strive to list the specific scope of non competition obligations as much as possible, including industries and products that do not engage in competition, positions and functions that do not generate competition, in order to reduce the possibility of assuming responsibility and retain greater space for the future.

·Industry (product) non competition: Disclose whether there is external investment or part-time work in industries with direct competitive relationships. If it involves industries, clear classification of restricted industries should be made, and the classification method can refer to the "Industry Classification Guidelines" issued by the China Securities Regulatory Commission. However, when the industry cannot be refined, a comprehensive definition can be made based on the type of product.

·Business non competition: When setting business restriction clauses, it is necessary to accurately define the restricted business types, clarify whether the restriction is dynamic or static, and whether it applies to existing or future business types before the delivery date; If future business is restricted, it should be noted that this may result in the commitment party being forced to limit its own business once the target company expands its business. At the same time, it is necessary to distinguish whether the restrictions are on "all businesses" or "main businesses": if "all businesses" are restricted, the target company's small-scale occasional businesses may also trigger restrictions, which will significantly increase the default risk of the commitment party and increase the post investment management burden of the acquirer. It is necessary to continuously track the business dynamics of both parties to ensure compliance.

·Personnel non competition: For the founding shareholders, they will naturally become the target of establishment and should actively disclose their part-time job information to external parties. Except for situations exempted by investors, they should devote all their time and energy to the target company. For core technical personnel, they are the core assets of the company, so locking in core personnel has become a choice for many investors, usually requiring them not to engage in business that competes with the company during their tenure and for two years after leaving. For university professors' part-time jobs and foreign investments, they should comply with national laws and regulations, policies of the Ministry of Education, local regulations, and internal systems of the university. The investor should review the relevant documents and request exemption from the university. The technology transfer of the founding shareholders during their school years faces multiple restrictions, and investors should review the relevant invention and creation agreements to avoid ownership risks.

(7) Promise

A commitment refers to a written agreement made by one or more parties to another party in a capital increase agreement, which is a specific action (positive commitment) or non specific action (negative commitment) during a specific period (such as transition period, initial shareholder shareholding period, post delivery commitment), usually made by the financing party (i.e. target company and initial shareholders) to the investor.

Positive commitment, which requires the company and its founders to engage in certain behaviors during a specific period of time. For example, most science and technology innovation companies may have policy support for local assistance and need to change their registered address to a relevant industrial park; The founding shareholders who contribute intellectual property rights shall fulfill all their paid in capital obligations (specific steps can be found in "(III) Contribution Method Clause" of this article); As soon as possible after the delivery date, apply to relevant government departments for the registration of trademarks, software copyrights, patents or other intellectual property rights required for the company's main business, and make every effort to protect the company's intellectual property related interests, ensuring that the company has legal ownership or use rights of all intellectual property rights required for business operations.

Negative commitment, which requires the company and founding shareholders not to engage in certain specific behaviors unless they have obtained written consent from the investors in advance, is generally limited to the transition period. For example, during the transition period, key provisions of the company's articles of association cannot be modified; No disposal, acquisition or encumbrance shall be placed on any significant assets; No new shares, options, or convertible securities shall be issued (unless it is an employee incentive plan that has been disclosed to the investor and approved by them).

The best way to fundamentally reduce the time and risk constrained by transition commitments is to shorten the transition period from agreement signing to final delivery as much as possible.

Conclusion of this article

Lawyer Liu Jing graduated with a master's degree from the School of International Finance Law at East China University of Political Science and Law. She has worked for multinational corporations, securities companies, and public fund management companies, with a complex professional background. She has in-depth theoretical research and rich practical experience in fund investment, corporate governance, and data compliance, and has sustained sensitivity and insight into financial product innovation and regulatory dynamics.

Lawyer Liu Jing has been in the industry for more than ten years, providing comprehensive legal advisory services to various enterprises all year round. She fully understands the impact of macro regulatory environment on project investment. Lawyer Liu is able to dynamically apply laws and regulations to conduct detailed risk assessments in advance. By sorting out the business logic of target projects and combining it with tax collection management practices, she can achieve more effective risk control.

Lawyer Liu Jing is particularly skilled in providing comprehensive services and risk control opinions for the fundraising, establishment, investment trading, and fund accounting of RMB and USD fund projects. Her advisory clients include securities companies, fund companies, futures companies, provincial investment platforms, government guided funds, etc.

Lawyer Liu Jing has qualifications in securities, funds, and futures, and holds certified certificates in data compliance and risk control. She is currently a member of the Fund Business Committee of the Shanghai Bar Association, a researcher at the Capital Market Research Center of East China University of Political Science and Law, and a practical mentor at the Law School of Shanghai University of Finance and Economics.