This article is the first in the "Guidelines for Chinese Enterprises to Invest in Vietnam" series, aiming to introduce the laws and regulations related to investment in Vietnam and provide corresponding risk summaries, providing reference for enterprises and related parties interested in investing in Vietnam.

1、 Investment regulatory department

The central government department responsible for investment in Vietnam is the Ministry of Planning and Investment, which has 31 departments and research institutes. It is mainly responsible for managing national plans and investments, providing comprehensive reference for formulating national economic and social development plans and economic management policies. It is responsible for managing domestic and foreign investment, managing the construction of industrial and export processing zones, leading the management of the use of official development assistance (ODA), managing bidding for some projects, establishing and developing various economic zones and enterprises, collective economy and cooperatives, and statistical centralized responsibilities.

2、 Investment industry regulations

The revised Law on Investment of Vietnam in 2020 and the Law On Import Duty and Export Duty of Vietnam in 2016 can be found on the website of the Ministry of Commerce for detailed versions.

( http://policy.mofcom.gov.cn/page/nation/Vietnam.html#Law )

3、 Investment methods

According to Vietnam's Investment Law, foreign investors can choose investment fields, investment forms, financing channels, investment locations and scales, investment partners, and investment project activity periods. Foreign investors can register and operate one or more industries; Establishing enterprises in accordance with legal provisions; Independently decide on registered investment and business activities. The investment forms that investors can engage in include:

(1) Investment in the establishment of economic organizations (including the establishment of representative offices, trading companies, limited liability companies, joint-stock companies, etc.);

(2) Investing or purchasing shares, or investing in capital;

(3) Implement investment projects;

(4) Invest in the form of BCC;

(5) According to the new investment forms and types of economic organizations stipulated by the government.

4、 Investment Access

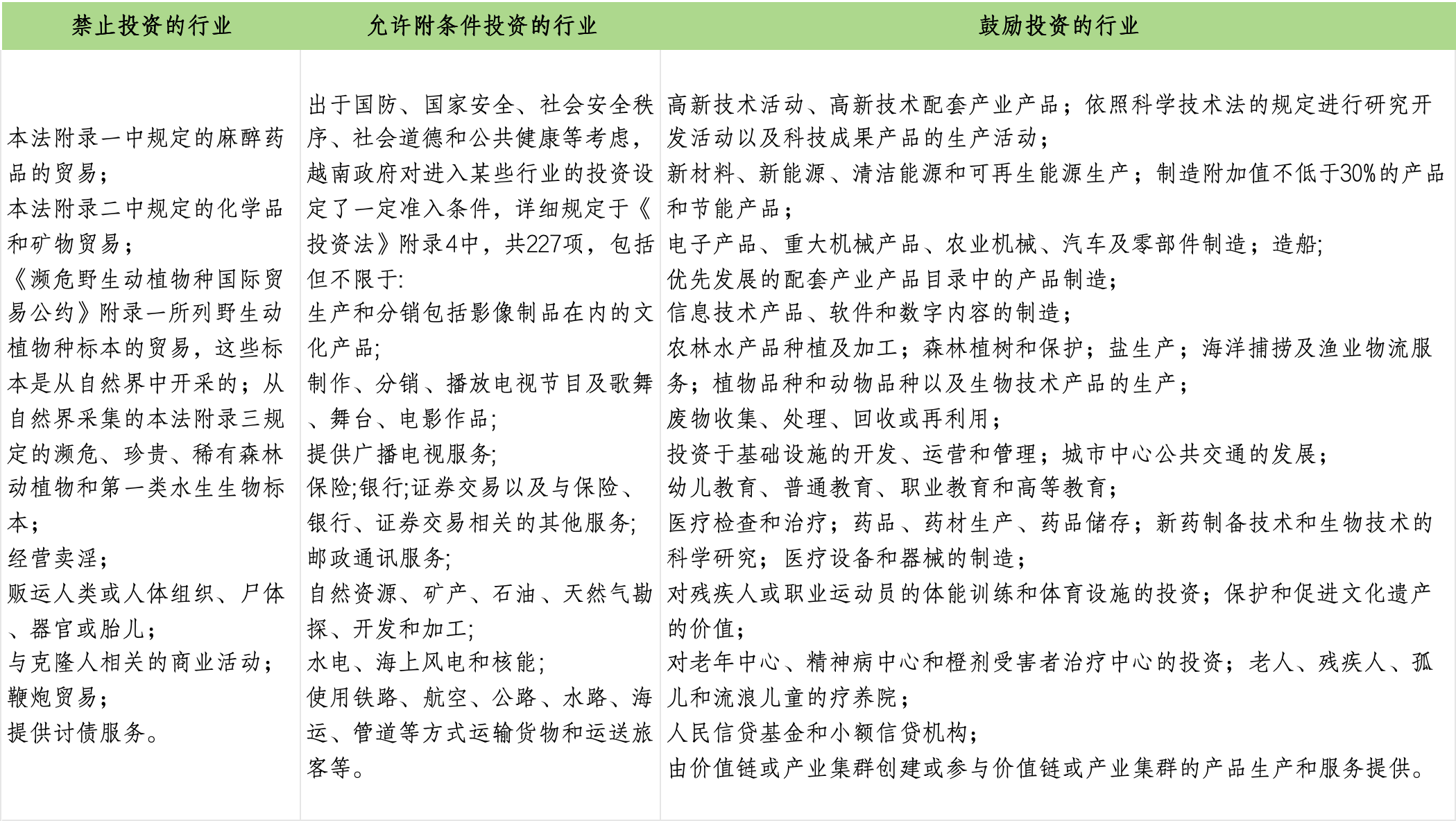

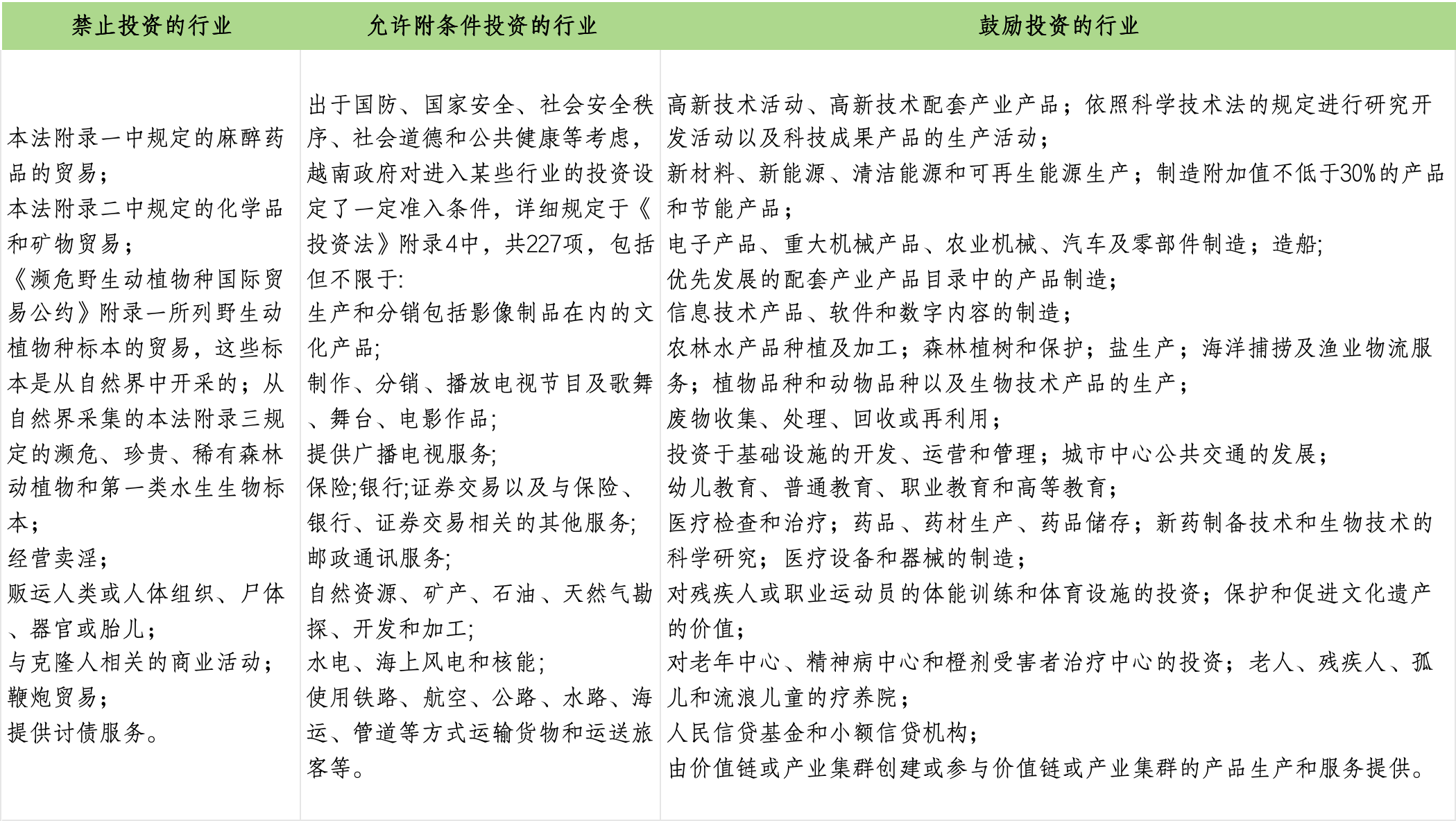

According to the current effective Vietnam Investment Law (61/2020/QH14), it can be seen that industries that are explicitly prohibited, allowed to invest with conditions, and encouraged to invest are classified as follows:

In Vietnam, foreign investors generally have the right to enjoy the same market access conditions as domestic investors, and most industries such as trade and manufacturing allow 100% foreign-owned operations.

However, foreign investment is prohibited in 25 industries, including news, security, judiciary, public opinion polls, explosives, military and police material production, intellectual property appraisal, dismantling of ships, aquaculture, water area investigation, transportation vehicle testing, natural forest development, and commodity transshipment and temporary import and export.

In certain specific industries, the government should publish a list of industries and trade restrictions on market access for foreign investors, requiring them to meet specific conditions, including joint ventures with local Vietnamese enterprises. For example, in the financial sector, the upper limit of foreign ownership in Vietnam's investment banking industry is 20%, while for non bank credit institutions (such as financial companies), the upper limit of foreign ownership is 50%. In the logistics field, the upper limit of the foreign shareholding ratio of logistics companies involved in container processing business is 50%; If the company's business only involves customs declaration, although there is no upper limit on the proportion of foreign shareholding, foreign investors must establish a customs declaration company in a joint venture with local Vietnamese enterprises.

Ashely Chen

Mobile phone: 13761265144

Lawyer Ashely Chen holds a Bachelor's degree in Law from Shanghai University of International Business and Economics and a Master's degree in Law from East China University of Political Science and Law. She is also a part-time professor and extracurricular mentor at Shanghai University of Political Science and Law. She is also the founder of the "National Innovation Public Welfare Fund" at East China Normal University, a guest lecturer at Shanghai University of Finance and Economics, an outstanding female lawyer in Putuo District, a recipient of the Shanghai Foreign Professional Lawyer Evaluation, a member of the Royal Chartered Arbitration Association, a mediator at the China Council for the Promotion of International Trade/China International Chamber of Commerce Mediation Center, a legal advisor to the Consulate General of the Republic of India in Shanghai, and a legal advisor to the.

Lawyer Juno Wang, with a Bachelor's degree in Law and a Bachelor's degree in Literature from China Agricultural University, has worked in large civil aviation central enterprises and foreign non litigation legal service teams, and has practical experience across industries and backgrounds. In recent years, Lawyer Wang Yu has conducted in-depth research in the field of non litigation and litigation services related to foreign law, representing dozens of overseas clients in international trade litigation in China and assisting in cross-border mergers and acquisitions.